Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.

Explore tax-smart gift options

Learn about gifts that maximize the impact of your support while providing tax benefits for you!

Stocks and securities

Many people love donating stock or mutual funds because it may help them avoid paying capital gains taxes.

Donor Advised Funds

Easily recommend grants to Gannon University for tax-efficient giving.

Cryptocurrency

Donate Bitcoin, Ethereum, and more to save on taxes and make a big impact.

Qualified Charitable Distributions

Use your IRA to make tax-free gifts that benefit you and our mission.

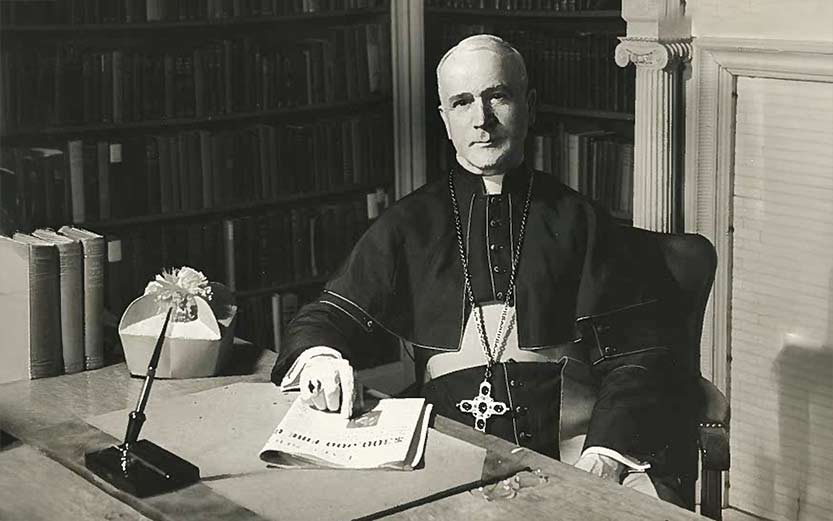

Planned giving helps fuel Gannon’s mission

The Archbishop Gannon Founder’s Society honors supporters of Gannon University and Villa Maria College who have included Gannon University in their estate plans. These gifts leave a lasting legacy by becoming part of the permanent life of the University.

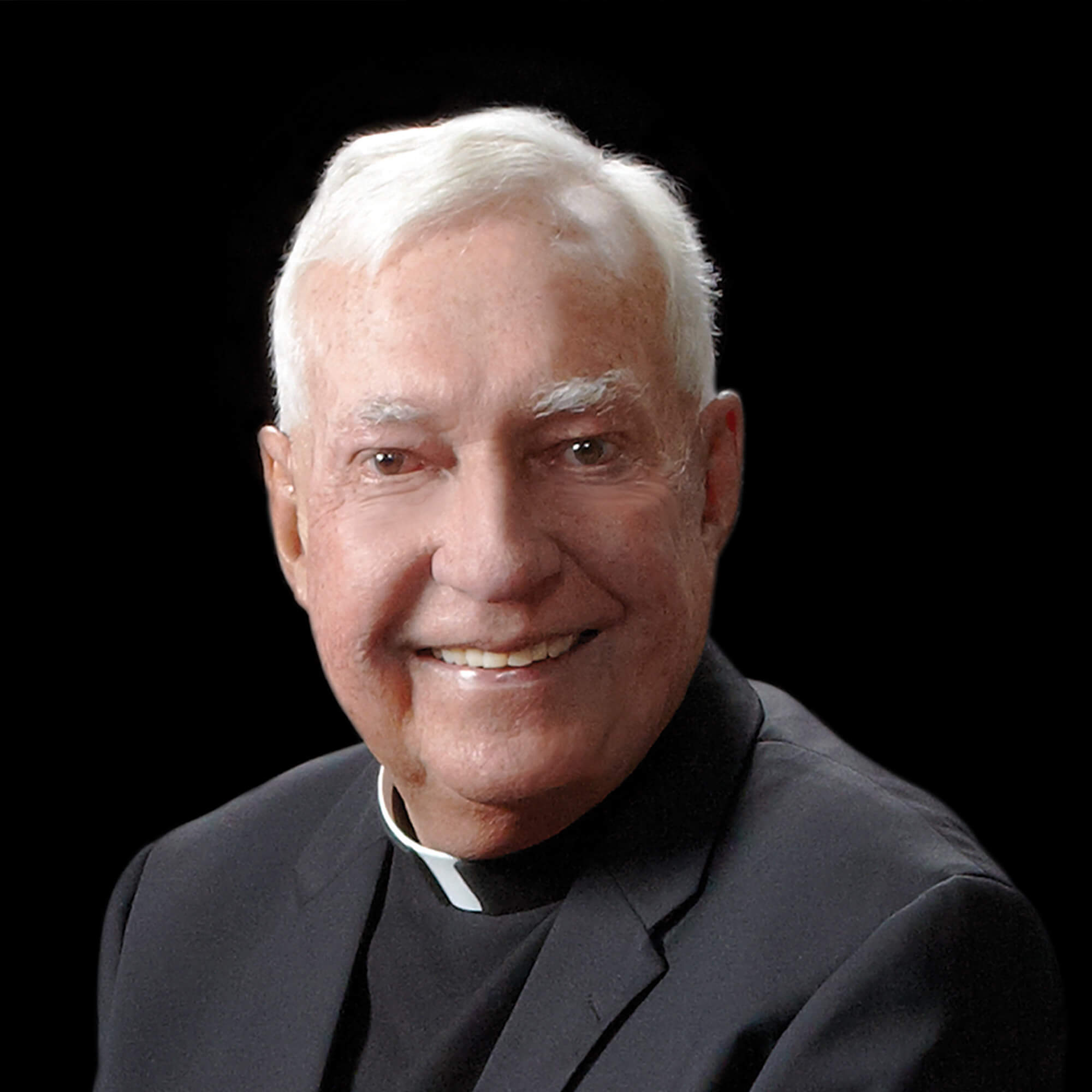

I felt a debt of gratitude toward Gannon when I was getting close to retirement. I thought this is something that I should do. I feel in a small way, I’m trying to pay back for all the University gave me.

Monsignor Henry Kriegel

We’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Nancy Bird

Title :Vice President for University Advancement

Phone: 814-871-5435

Email: bird013@gannon.edu

Already included us in your estate plan? Let us know

More ways to make an impact

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will (for free!).

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.